Greg Lundgren Wants to Turn the Lusty Lady into a For-Profit Arts Center and Manufacture a Renaissance

by Brendan Kiley | August 30, 2011

Greg Lundgren has a big, improbable idea. That's not unusual—he has big, improbable ideas all the time. What's unusual is his ability to make so many of those ideas work so well. Lundgren's mental progeny include the Hideout, an art gallery/bar/"performance installation" where you can buy a painting and a drink and talk to an actor "playing" an eccentric bar patron (the Hideout was praised in the New York Times just four months after it opened); Lundgren Monuments, whose cast-glass headstones sit in cemeteries around the world, revolutionizing how the death-care industry thinks about art and design; and Vital 5 Productions, which won a Stranger Genius Award in 2003 and launches imaginative, counterintuitive projects such as arbitrary art grants, theater events that take place outdoors while the audience sits in a storefront and watches through the windows, and disinformative guerrilla tours of major art museums.

But Lundgren's new idea, called Walden Three—next in line after Thoreau's Walden and B. F. Skinner's Walden Two—is his biggest and most ambitious yet. "Everything I've done in life has been a series of exercises to prepare for something significant," he says, sitting at his kitchen table, pouring himself a glass of rosé. "I want this project to manufacture a cultural renaissance in Seattle. We have everything we need—an incredibly talented pool of artists and thinkers, a thriving cultural community, a serious concentration of wealth. There are more millionaires in King County than in the entire state of Connecticut. We can create a golden era for Seattle art and artists. It just requires people being big dreamers, people who'll take the risk."

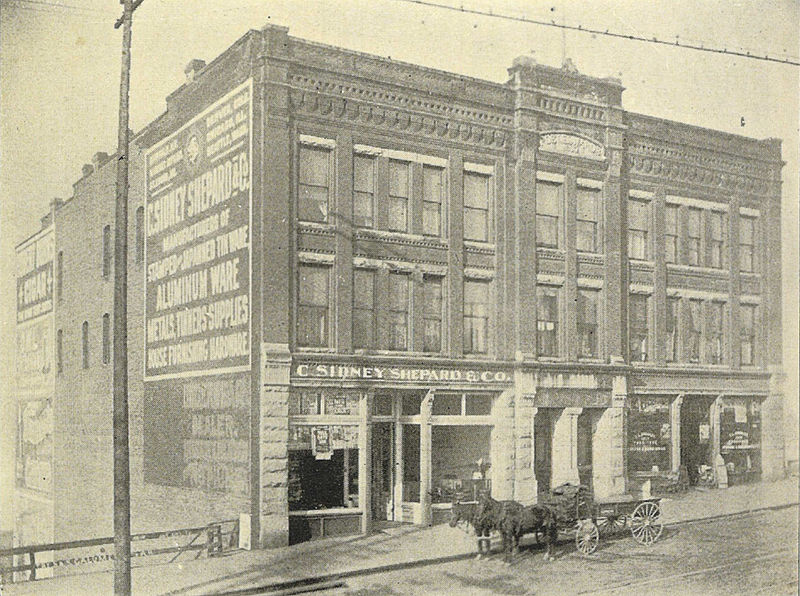

The dream: take over the Seven Seas building—former home of the venerable Lusty Lady peep show, just across the street from the Seattle Art Museum on First Avenue—and turn it into a six-story art center, cultural engine, and film set for a 10-year documentary that will record, according to Lundgren's preliminary business plan, "the cultural renaissance of a major American city... By all measures, it is a social experiment."

The imagined top floor of Walden Three is for noncommercial art: objects and performances not intended to make money. (This floor is designed to operate at a loss.) The next floor down is a commercial gallery for a rotating series of Northwest curators, both new and estalished. The next floor—the street entrance on First Avenue—has a lobby, coffee shop, peep-show installations, and a storefront art school with lectures and art classes for a nominal fee: businesspeople taking drawing classes on their lunch breaks, people coming for lectures in the evenings, and so on. The next floor down is an artists' bazaar (imagine I Heart Rummage or Urban Craft Uprising crossed with the Pike Place Market) with 100 booths that can be rented on a monthly basis. The next floor down is the Walden Three command center, with production offices, living quarters for visiting artists, a commercial-grade kitchen, and meeting rooms. The bottom floor is a commercial bar space, leased to someone other than Lundgren. "I want it to be really fun and trashy," he says. "The constant party place for all the things happening in the rest of the building."

If Lundgren's big idea works, Walden Three will become a six-story antenna where Seattle's culture constituency can broadcast itself not just to the city, but to the rest of the world.

That's where the cameras come in. According to Lundgren's business plan, "the art center and the film are intrinsically linked to each other like Siamese twins—partners that make each stronger and more dynamic than they could possibly be alone." Whether Walden Three is a spectacular success or a flaming failure, Walden Three has a shot at being an engaging documentary. The worst thing would be if Walden Three were boring. "And I will not," Lundgren says, "allow that to happen."

A full-time videographer and editor would record footage throughout the process, uploading trailers, lectures, art openings, performances, and interviews to YouTube and Vimeo, creating what Lundgren calls "a propaganda machine" for Seattle culture. The presence of the camera, he hopes, would instigate an observer effect, raising the stakes for everyone involved. (He also imagines having a stylist on the lobby floor, where people can get dolled up before walking onto the Walden Three "set.") "You can have a shy, retiring artist," he says, "but that shy artist will create a different show for Walden Three than they would for a coffee shop. We are going to show their art to potentially millions of people—that will step up everybody's game."

Lundgren also points out that the film would have the unusual potential to influence culture before it's even released—that simply shooting footage of Walden Three as it happens and posting snippets online could have a noticeable positive effect. "That's the social engineering part," he wrote in an e-mail. "People will dress differently, art patrons will buy differently (or people who don't have a history of buying art will start to), and artists will create differently (hopefully to a higher level). The observer effect works in the arts very well—Seattle just hasn't had enough people watching."

Another unusual feature of Walden Three is its for-profit business model. "I don't think I'd ever open a nonprofit business," Lundgren says. "By constantly soliciting the community for money, you're saying we are anemic, we are dying, we cannot sustain ourselves. We know from basic psychology that people are not attracted to things on the brink of death—people are attracted to things that are successful.

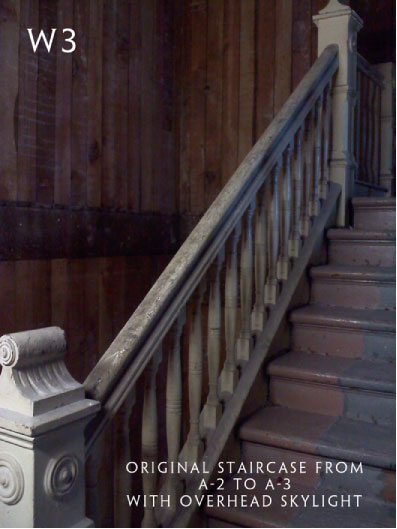

According to Lundgren's current calculations, Walden Three will need more than $6 million to finance the remodel, the start-up expenses, and the salaries for Walden Three's 12 full-time employees for the first year. (The business plan has pages and pages of things that need fixing or getting: museum track lighting, 200-amp house panels, a gang drain in the stairwell, a 4,500-pound elevator, trash cans.)

Six million dollars is a lot of money, especially for the arts. Especially now.

"Yes," Lundgren says. "It sounds improbable—but it's possible. It's dangerous to project your own poverty onto your projects. If the capacity exists, it's worth trying." He takes another sip of wine, smiles, and says: "We can manufacture a renaissance."

The Stranger

Building A Stadium

by Greg Lundgren | August 25, 2011

In 1900, Frederick Weyerhäuser bought 900,000 acres of timberland in the Pacific Northwest. His ability to recognize and exploit the region’s natural resources eventually made him the 8th richest man in American history, with a net worth of $72.2 billion.

Today, our region’s resources are harder to recognize. If some device could reveal our most prominent resource, it would squarely point to our creative capital. The sheer brainpower of artists and thinkers in the Pacific Northwest is staggering—and more valuable than the ocean of oil under Saudi Arabia. Ideas are the most powerful assets of any culture. They shape the future of our politics, our technologies, our morals and ideals. Ideas hold the power to save us.

So why does the Northwest remain in the shadows of New York and other titans of contemporary arts and culture? Why hasn’t our creative class been discovered, harnessed, exploited, exported? Unlike an expansive forest of old growth trees or an ocean of oil, our artists and revolutionary thinkers are not an easy resource to identify. We scorn self-promotion. We lack a hive for creative congregation.

We are too young to capitalize on our cultural heritage. In Seattle, our freedom to explore and experiment is outstanding, and the sense of community and quality of life are second to none. But there is too little competition and too few people are paying attention. Stimulating our creative class will help retain it.

Broadcasting creative ideas will seduce other artists and thinkers to our region. We have the ability to be Florence in the 1500s, Paris in the 1920s, New York in the 1960s. All of the components are here to create a golden era, but it requires a shift in the way we think and present our ideas.

I recently had a conversation with a group of painters who were critical of some artists in this city who they felt were too brash, too self-assured, too opportunistic. I reject the notion that art is for a select few and that promoting your ideas signifies an inflated, unhealthy ego. As an artist, a thinker, a person with an idea, if you are confident that your work will make the world a better place, it’s not grandstanding to propagate that idea—it’s your moral obligation. If you see a shark fin heading toward the beach, you don’t whisper about it to a few friends, you shout at the top of your lungs.

We need to broadcast our art and our ideas—to export our voice and observations to as many people as possible. Our audience is not “the art community” but the world at large. Starting to sound like religion? Yes, of course it does. Because art and culture is what I believe in, it is our salvation, it holds the power to halt war, seed love, pave the way for freedom, fortify education and beauty. Art and culture bring us together.

We need a stadium for the arts. A place where artists and thinkers can train, compete, experiment and perform. A beehive that can electrify our creative class and inspire its audience. An urban station that can constantly produce creative content. And we need to broadcast this activity to the world.

I have a template for such a stadium, hosted in a vacant 25,000 square foot building directly across from the Seattle Art Museum. My stadium is called Walden Three—a $15 million, for-profit, 20-year project that is equal parts art school, exhibition space and documentary film.

Thoreau’s Walden was a personal declaration of independence and an isolated social experiment that unfolded in a cabin in the woods on the outskirts of town. B.F. Skinner’s Walden Two scaled Thoreau’s experiment to a commune of 1,000 people that embraced “a constantly experimental attitude towards everything.” Walden Three employs the same cultural engineering and also examines the world on a global scale. But Walden Three is not a book; it is the day-to-day manifestation of contemporary art recorded and broadcast as a documentary film. Crating an artist’s work and shipping it to another gallery in another city is a crude, ineffective way to activate ideas. (It only works if you consider art a money-making commodity, not as a vehicle for sharing ideas with the masses.) We need film and technology to break through the bubble that surrounds our region—to reach the greatest possible demographic and convey every dimension of our successes, failures and humanity.

Walden Three asks one central question: Can a renaissance be manufactured? I believe it can and I believe Seattle holds all the key ingredients to activate such a golden era. We have the creative capital to fuel it, the proper space to house it, the technology to propagate it and surely someone in our midst with the audacity to finance it.

Do we hold our breath and cross our fingers and hope for this to happen organically? Or do we construct a model that can ignite our creative capital and effectively harness this vast, largely untapped resource?

We will be remembered and defined by our artistic cultural heritage. Who will be the Medicis of the Pacific Northwest? I’m not sure, but I want to get their attention and present to them an opportunity to forever define this region. It’s my job as an artist to propagate what I believe in.

City Arts

Culture Forest

by Greg Lundgren | December 2012

If you want to know where the next big development will happen, look for drug dealers and prostitutes. They operate on the fringe of a city, as close to the core as possible without drawing attention to themselves or their patrons. I know this because, as an artist and gallery owner, these are the neighborhoods that developers have endorsed me to occupy with the hopes of seeding culture and helping to transform the perception of these areas.

During my recent experience renovating, curating and evacuating a building slated for destruction, I realized three things:

1. Seattle has an exceptional creative class.

2. This group thrives when given the opportunity and a platform.

3. Short-term art spaces only underscore the need for long-term investments in regional contemporary art.

If artists are employed to change the perception of a neighborhood – to make places more desirable and breathe energy into our downtown core – why are they given such short-term opportunities? Progressive developers recognize the value of long-term cultural districts and seek to establish communities around these hubs, capitalizing on our desire to live, work, shop and engage in neighborhoods with galleries, theaters and other channels of creative output.

In reality, these hubs have been dismantled and scattered, given temporary shelter only so long as it is convenient to big (short-sighted) business. Transient communities rarely flourish; instead, they focus on daily survival.

Rather than create single crops of artists who are nurtured and cut down at the end of each season, we need to grow a culture forest—a place that protects, fosters and inspires our artists and community. All that temporary housing and support does is prove that the soil is rich, and the seeds are strong. A protected, nurtured environment allows saplings to turn into titans. With strategy and premeditation, these cultural districts will not only grow but pay out dividends to the city, businesses and citizens that endorse them.

A city's value and allure is defined by its culture, and we should protect ours like a wildlife refuge. Yet, this is not philanthropy, goodwill or charity—it is good business. Because this culture forest is not a liability or government subsidized public service, solid data proves it bears an enormous revenue stream for the city, developers and neighboring businesses.

Facts:

1. Over nine million tourists visit Seattle each year, spending well over $5 billion.

2. Arts commerce in the city of Seattle grosses over $447 million annually.

3. King County arts generate over $38 million in city and state taxes.

Seattle has a long-standing history of clear-cutting our culture forests. Our politicians undervalue them, and our developers fail to protect them. Instead of accepting that our artists and culture hubs will exist temporarily in the shadow of development, we must identify spaces that could serve as long-term guardians of arts and cul- ture and petition people with the means and vision to cultivate them.

We need to look at our city core through a new lens and survey our urban landscape for the location of a culture forest. Maybe it's an old hotel, a city-owned building or an industrial space that has yet to see a wrecking ball. As the Washington Shoe Building and 619 Western have proven, finding an old building is not enough—they need to be protected from the bureaucracy, greed and shortsightedness that courses through the veins of any city.

Culture forests should be controversial and risk-taking; they should be allowed to experiment and fail and grow. This seeming recklessness is the birth of invention: anarchy is what breeds industry. As much as I would like to rely on developers and politicians to champion and protect areas for arts and culture, I think it is the duty of the rich (there, I said it).

It is my hope that there is a Medici, a Rockefeller or a Guggenheim in our midst who recognizes the value and thrill of underwriting a cultural renaissance, the importance of artistic experimentation and the rewards of a culture forest, in this decade and for generations to come.

Seattle has an incredible arts community despite the lack of cultural infrastructure to support it. Not only should we be concerned about retaining our creative class, we should be aggressively building a city that lures artists and visionaries to our shores.

We hold all of the potential to birth a true renaissance—all it requires is harnessing the greatest natural resource our city has and allowing it to thrive. Economically and culturally it is the right thing to do.

City Arts

"Vital 5 Productions founder Greg Lundgren stops by to talk about his ambitious new project, an art center called Walden 3. We also talk about Seattle's art history and the bar he co-owns, The Hideout."

Ordinary Madness #8 GREG LUNDGREN

Manufacturing Renaissance: An Interview with Greg Lundgren

August 4, 2012 | Interview conducted by Jake Uitti

Seattle artist Greg Lundgren—impresario of Vital 5 Productions, The Hideout and Vito's—believes he can manufacture a cultural renaissance. This rebirth in the arts would take the form of a documentary film called Walden Three. The film would track the renovation and opening of a multi-use, commercial arts space in the Seven Seas Building on 1st Avenue—formerly the home of the famous Lusty Lady. He calls the project "a stadium for the arts," a moniker that only begins to cover the scope of his vision. The Monarch Review had a chance to catch up with Lundgren late in 2011 and inquire about this vision.

MR: If there is one reason Walden Three is essential, what is that reason?

GL: Spider-Man's uncle Ben once said: "With great power comes great responsibility." I think that Seattle has all of the essential ingredients to innovate, inspire, and transform our relationship with art and expression. We cannot rely on another city with lesser talent, lesser resource and less innovation to change the way we value and consume art.

MR: Where do you see the role of politics in Walden Three?

GL: As unpopular as it sounds, I have little faith in contemporary politics. I remain in awe of our Constitution and the tolerance our society has for self-expression and freedom of speech, but I do not believe mayors or presidents are going to solve our greatest problems.

MR: Where does the "art utopia" possibility of Walden Three stand in regard to the poverty building all around us?

GL: We allow poverty. It is not some other president's fault, it isn't some corporation's fault, it is our very own fault. And the remedy for poverty and war and crime is a society that is courageous, active and ready to stand up against injustice. Walden Three aims to strengthen and empower people to use their voice, to express themselves, and to stand up for what they believe in. It isn't just about painting and writing and installation art – it is about realizing that we have the power to change anything – that 'we the people' are in charge. Walden Three is an exercise program, a candy flavored medicine, designed to foster a participating, communicating, fearless audience. And I don't believe in utopias, I believe in the pursuit of a utopia.

MR: When I talk about the idea for Walden Three, I am either met with enthusiasm or something like: "Why does Seattle need another venue, we have plenty already?" To this you say what?

GL: Walden Three isn't a venue – it is a film. And it is privately owned – not asking for a dollar from the city or the people of Seattle. Something is going to go into the Seven Seas Building. Maybe it will be a new Barney's department store, or an office for Google, or a new Cheesecake Factory. I want to see it become the cultural engine of our downtown core.

MR: Do you anticipate receiving funding for Walden Three? Will investors become partners? What do you think when I say the name 'Paul Allen'?

GL: I do anticipate receiving funding. It's a smart idea, it holds a great return for the investor and there are a wide variety of places the capital could come from. But it requires patience and perseverance. Investors in Walden Three would play the same roles as they would in any traditional film sense. The film has structure and a code of conduct. And the investor isn't involved in daily operation or programming. Paul Allen holds the capacity to change the world in profound ways. All billionaires do, and I think most billionaires want to. I think he wants to, and I hope that someone from the Allen Foundation reads the business plan for Walden Three.

MR: How do you plan to pay your employees and the artists who participate?

GL: Walden Three would have 12 full-time employees and 3 part-time, all earning a livable salary with health care. There would be an equal number of interns working for college credit or the colorful work experience W3 would provide. Artists exhibiting work for sale in the gallery would receive 50% of sales, and artists showing non-commercial work would receive stipends and budgets for materials.

MR: You've said Seattle's creative ability is our main export and that you want Walden Three to be a for-profit entity. What exactly do you hope to export and to whom?

GL: Walden Three is a feature length documentary film founded upon the conviction that Seattle has a wealth of creative capital, that art and expression hold the power to change the world and that it is our responsibility to pursue a better world. That idea is the primary export. But during the production of the film, there are a number of secondary exports that come in the shape of shorter films, educational programming, art sales and the regional artists we support. Who is our audience? Everyone. If the building is on fire, you scream at everyone to get out.

MR: Will there be something like a board of directors?

GL: Yes, definitely. W3 is all about constant conversations and looking at art from a variety of perspectives. It requires the dialog of curators and artists and dealers as well as dialog from engineers, architects, chefs, teachers, entrepreneurs and musicians. Our success hinges on this diversity of talents and perspectives, primarily from outside the arts complex. It is important to state that I am fully aware of my limitations, and that I require experts in other fields, and different perspectives to give W3 the traction to reach popular culture and compete against prime-time television and sporting events and video games and the uninspired.

MR: What style do you envision for the place, aesthetically? What mood?

GL: The main galleries are big raw boxes. Wood floors, white walls, exposed beams. Simple. Capable of transforming to the needs of installations or falling into the background for a performance. The beauty of the Seven Seas Building is in its big, wide-open spaces, and for the exhibition spaces, they should be left as such. Nothing should be decorative or too precious. Everything should be adaptable, transformable. It is a living, breathing space and each artist is going to make it their own. The only space that has any defined aesthetic is the ground floor entrance, which is the portal to W3 and serves a multiplicity of roles – classroom, coffee shop, workspace, lounge, lecture hall, social space. The mood would be part hotel lobby (Ace Hotel), part classroom (Bauhaus), part social space (Oddfellows), part laboratory (City of Lost Children). I am a minimalist in the realm of aesthetics and a maximalist in the realm of ideas.

MR: What sort of galleries, venues and practice spaces do you hope for W3? How will they be organized? Any unique security?

GL: Walden Three, as specific to the Seven Seas Building, occupies six floors, with different activities happening on each floor. The top floor is designated as a non-commercial exhibition/performance space. The only caveat is that the work does not have a price tag on it, and admission is always free. The second floor is a commercial gallery/performance space designed to make money and sell as much work as possible. The main entry floor is designed for arts education (both studio and lectures), social meeting space, coffee shop and a variety of interactive activities and peep shows. The floor below that is an artist's bazaar, and below that is a private floor for arts and film production, offices, kitchen and a one bedroom apartment for visiting artists. The bottom floor is a nightclub, accessible from Post Alley. W3 is not designed to host practice spaces or studio space – it is primarily geared for exhibition, education and social interaction.

MR: What type of restaurant/bar/café infrastructure do you envision? How might Vito's and the Hideout play into the plan? Will you seek out independent chefs?

GL: The Hideout and Vito's were both very important lessons for me and proof positive that social space is critical to the creative process. In W3, there is a nightclub on the ground floor, and a coffee shop on the first avenue entrance, and both would be sublet to competent, dynamic parties. I do not think that W3 as a film should be operating the bar and café on top of everything else, and these types of creative partnerships actually become income-generating aspects of the project.

MR: What is the role of politeness in art? Is there space for negativity in critique?

GL: If your friend has a stupid shirt on, you are doing him no favors by telling him it's nice. There is a polite way to tell him it sucks, and that is the attitude I take towards art. People who are making art are at least trying, and that is more than most people – so there is credit due. Our job as humans, as friends, is to first recognize that our opinion is subjective and not the law, and secondly to present our opinions in a way that can help correct the errors that we see. Telling someone their shirt sucks can be helpful, but you have to go into their closet or help them fix that problem. Saying something sucks is not enough, it's too easy and it's counterproductive. We should want people to make the best art possible, and sometimes that is an awkward, clumsy affair. And sometimes, we are the one wearing the stupid shirt, and the stupid shirt guy is just so above our level of cool that we don't even get it (until later).

MR: How can classes and teaching be integrated into W3?

GL: The budget allocates two full-time art instructors at W3. It is critical to provide an education to the community – to both understand the history and theories behind art practices, and to teach people how to express themselves through various mediums. But teaching is a fundamental aspect of W3. All classes are $1.00 each, and all classes are streamed on the internet so people around the world can learn and participate in our project.

MR: When do you want this project to begin?

GL: Everyone wants to know when it will start, if I have the keys and when the first show will be. I have no idea. And I won't until a serious investor raises their hand. But I don't think it is impossible and I do think that there are plenty of people who, if exposed to it, would sign on (the trouble is getting their attention). It is like trying to break out of Alcatraz with a soup spoon. You can either sit on your hands or you can chip away at that concrete wall and try to escape. It might take longer than I would like, but the alternative is to accept things as they are, and I just can't do that.

MR: What one thing worries you most of all about the project?

GL: In the past, all of my art projects have been self-financed, so I've never had to bend to appease another party. The only fear I have is that the investor isn't patient enough or confident enough in our direction to let W3 mature on a natural course. I want to make certain that the investor has the vision and confidence to understand that this is an experiment and that in order for it to succeed, for it to reshape popular culture, it needs to buck convention, present unpopular ideas, rebel against our own beliefs and be a wild, reckless teenager. W3 is designed to explore some uncharted places and that requires an investor with some balls (male or female – I just can't think of another word!) Maybe my proposal should be titled: W3 SEEKS AN INVESTOR WITH BIG BALLS.

Monarch Review

I endorse Walden Three and think that our region, our artists and our community would greatly benefit from a long-term art center in the downtown core.

Curators, Directors, Arts Administrators

- Greg Lundgren, Executive Director, Vital 5 Productions

- James Keblas, Director, Seattle Office of Film + Music

- Barbara Shaiman, Exhibitions Director, SAM Gallery

- Jim Kelly, Executive Director, 4Culture

- Wier Harman, Executive Director, Town Hall Seattle

- Nicole Dement, Program Manager, Artist Trust

- Emily Glassman, Head of PR & Original Content, IMDB

- Strath Shepard, Creative Director – Nordstrom + Land Management

- Beth Sellars, Curator, Suyama Space

- Matthew Richter, Executive Director, Seattle Storefronts

- Andy Fife, Executive Director, Shunpike

- Lane Czaplinski, Executive Director, On The Boards

- Robin Held, Executive Director, Reel Grrls

- Michael Seiwerath, Seattle Arts Commission

- Sierra Stinson, Curator

- Monika Proffitt, Executive Director, Starry Night

- Michael Hebb, Founder, One Pot

- Deborah Paine, Curator and Collections Manager, City of Seattle

- D.K. Pan, Free Sheep Foundation

- Beth Cullom, Owner + Director, Cullom Gallery

- Amanda Manitach, Curator, Hedreen Gallery

- Carrie Scott, Curator + Art Advisor

- Alison Kreitzberg, The Vera Project

- John Boylan, Writer/Provocateur

- Mathew Olds, Owner, Hold Studios

- Carl Sander, Public Programs Manager, Burke Museum

- Catleah Cunanan, Operations Director, Pinch/Zoom

- Kirsten Anderson, Curator + Owner, Roq La Rue

- Chris Weber, Programs Manager, One Reel/Bumbershoot

- John L. Messina, Director + Owner, Cage Shaking Productions

- Steve Peters, Director, Nonseqitur/Wayward Music Series

- Jeff Leisawitz, Mr. Electron Unlimited (patron)

- Lucas Spivey, Director, 17 Cox

- Mira Crisp, Creative Director, Get Crisp

- Sarah Brooks, Co-Founder, Artsyo

- Brad Trenary, Trustee, Raynier Foundation

- David Roesel, Red Wagon Productions

- Greg Kucera, Greg Kucera Gallery Inc.

- Scott Lawrimore, Curator, Frye Art Museum

- Migee Han, Development Director, Sightline

- Sue + Ron Peterson, owners + directors, Fountainhead Gallery

- Gary Mula, producer, Columbia City Theater

- Kathleen Waren, Director, Urban Artworks

- Colin Griffiths, Contemporary Art Logistics, Vancouver

- Mikey Rioux, The Sho

- Rod Hatfield, The Now Device

- Ryan James, Ryan James Fine Art

- Larry Choate, Harvard Business School

- Nancy Whittaker, Retail Manager, Bellevue Art Museum

- Victoria Luke, Business Manager, Pinnacle

"Walden Three is a bold, new-model arts catalyst for our city. It puts the arts scene of the upper-left-hand corner on center stage and gives it a center in which to explore, to stretch, to cross-pollinate and to matter in ways artists have longed for. And Seattle is ready for its close-up, Mr. Lundgren."

– Robin Held

Business Leaders

- Linda Derschang, Entrepreneur

- Jody Hall, Owner, Cupcake Royale

- Matthew Parker, Matthew Parker Events

- Olson Kundig Architects

- Barbara Malone, Sorrento Hotel

Artists + Designers

- Mandy Greer, Artist

- Susan Robb, Artist

- Serrah Russell, Artist

- Kathryn Rathke, Kathryn Rathke Illustrations

- D. Mihalyo, Lead Pencil Studio

- Annie Han, Lead Pencil Studio

- Charlie Schuck, Photographer + Owner, Object Store

- Ryan Mitchell, Artist + Saint Genet

- Jack Daws, Artist

- Jeff "Weirdo" Jacobson, Artist

- Curtis Taylor, Artist

- Degenerate Art Ensemble, Artists

- Klara Glosova, Artist/Curator, Nepo House

- Jason Puccinelli, Artist

- SuttonBeresCuller, Artists

- Robert Hardgrave, Artist

- Robert Zverina, Artist

- Ryan Molenkamp, Artist

- Leanne Grimes, Artist

- Shaun Kardinal, Artist

- Serrah Russell, Artist

- Joey Veltkamp, Artist

- Sharon Arnold, Artist + Curator at LxWxH

- Marge Levy, Artist + Curator

- Larry Rouch, Architect

- Jed Dunkerley, Artist + Educator

- Jess Rees, Artist + Designer

- Sara Edwards, Artist + Arts Administer

- Brenda Scallon, Artist + Caravan Gallery + Daughters of Joy

- Barbara Robertson, Artist

- Deborah Scott, Artist

- Just Sage, Artist + Performer

- Tim Marsden, Artist

- Steph Kesey, KeseyPollock

- Cheryl dos Remedios, Artist

- Kevin Furiya, Artist

- Caroline Alexander, Artist

- Lisa Buchanan, Artist

- Flatchestedmama, Artist

- Shaun Kardinal, Artist + Designer

- Rebecca Cummins, Artist + Educator

- Kristina Krause, Design Researcher, University of Washington

- Tiffany Lin, Artist + Tiflin + Prefecture Music

- Cathy McClure, Artist

- Rachel Ravitch, Architectural Designer

- Carol Adelman, Artist

- Maxx Lexington, Byte Graphx

- Nevdon Jamgochian, Artist

- John Schuh, Artist

- Geoffrey Garza, Artist

- Bruce Greeley, KCLS

- Nicola Vruwink, Artist

- Lanny Devuono, Artist + Writer

- Aaron Haba, Artist

- Michael Magrath, Magrath Sculpture

- Miguel Edwards, Artist

- Erin Shafkind, Artist + Educator

- Anna Hurwitz, Artist

- Saskia Delores, Artist + Entrepreneur

- Joy Hagen, Artist

- Rich Lehl, Artist

- Lisa Chadborne, Architect, Chadbourne + Doss Architects

- Vai Santo Domingo, Stylist, Vain

- Alan Fulle, Artist

- Ken Turner, Artist

- David Halsell, Artist

- Jacob Peter Fennell, Artist + Software Developer

- Sarah Lippek, Artist + Independent Investigator

- Jenny Soderlund, Artist

- Mary Iverson, Artist + Educator

- Jerry Garcia, Jerry Garcia Photography

- Amanda Ford, Artist + Muse Movement at MOVE

- Keirah Dein, Artist

- Troy Gua, Artist

- Mark Mitchell, Director, Mark Mitchell Burial Clothing

- Lisa Gitelman, Artist + LIZSZA

- Anette Lusher, Artist

- Trevor Johnson, Artist + Educator

- Yvette Neumann, Artist

- David Nixon, Artist + member of AWESOME

- Tamara Weikel, Artist

- Julia Haack, Artist

- Scott Foldesi, Artist

- Nelson Bradley, Artist

- Ronald Aeberhard, Artist

- Zalman Berkowitz, artist

- Alice Wheeler, photographer

- Jenny Littlefield, Artist

- Rachel Gallaher, Assistant Editor GRAY Magazine, Freelance writer

- Lisa Buchanan, Artist

- Breanne Gearheart, Artist + Landscape Designer

- Kate Fernandez, Artist + Educator

- Janet Galore, Artist + Curator

- Evan Flory-Barnes, Musician

- Katie Kadwell, Artist

- Marie Gagnon, Artist

- Christian French, artist

- Kevin Furiya, Artist

- Paul Konada, Artist + Soil

- Suzanne Beal, Writer + Art Critic

- Leiv Fagereng, Artist

- Erin Kendig, Artist, Publishing + Editorial Manager, ARCADE

- Lauren Brazell, Artist

- Lisa Herriott, Interior Designer

- Laura O Quinn, Designer + Educator

- Maria Palatini, Artist + Writer

- Sylwia Tur

- Adria Pauli

- Katja Kloepfer

- Doug Haire, Sound + Music

- Tom Mattausch

- Britta Johnson, Artist + Filmmaker

- Joya Marie Marsh

- Christopher Buening

- Debbie Ableson, Photographer

- Amanda Dellinger

- Anthony Linebarger

- Julia Khorsand, Designer, ZGF Architects

- David Hytone

- Daniel Hawkins

- Jessica Dolence, Artist + Designer

- Erin Pollock

- Kevin McCarthy

- Kerri Miller

- Joan Stuart Ross

- Aaron Murray, artist

- Christa Wilkinson, Xrista Design

- Andrea Steves, Fictilis

- Laura Brazell

- Sari Breznau

- Sean Frego

- Magdalena Hill

- Drew Shawver

- Tim Summers

- Leslie Ross

Patrons of the Arts

- Jake Parker

- Bridget Meyer, Chef

- Elise Gilbert, UMAMI Media

- Gregory Musick

- M.J. Marvin

- David and Janelle Saylor Price, Owners, Greenroom Décor

- Todd Gehman

- Anna Callahan

- Leslie Ross

- Mark Lewin

- Mark Sullo

- Juliet Sanders, patron

- Leslie Lowe, patron

- Carrie Clogston, patron

- Brad Thompson, patron

- Kosciusko-Morizet, patron

- Martha Dunham, Owner, Identity Expressions

- Michael Weisman

- Susan Christian, Project coordinator, Salon Refu

- Shelley McIntyre

- Chad Nikolz

- Kika Westhof

- Megan Dodge

- Misha Neininger

- Chanel Reynolds, Digital and Creative Consultant

- Annie Pardo, Live Nation Entertainment, Sponsorships

- Virginia Bunker, copy manager, Nordstrom

- Constance Awenasa

- Catherine Hillenbrand

- Philip Niemeyer

- Jennifer Hotes

- Juliette Rasmussen

- Amber William

- Dr. Tara Brooke

- Cinnamon Stephens

- Stephen Bentsen

- Eric Olson

The Seven Seas Building is immediately across the street from the Seattle Art Museum and the Lusty Lady marquee often commented on current exhibits or the Hammering Man statue. Mimi Gates called the Lusty Lady's marquee a Seattle landmark.

The Seven Seas Building is immediately across the street from the Seattle Art Museum and the Lusty Lady marquee often commented on current exhibits or the Hammering Man statue. Mimi Gates called the Lusty Lady's marquee a Seattle landmark.